Fraud Prevention Management done your way

Fraud is an active threat, your defense should be just as proactive

Fraud prevention redefined, smarter, faster, stronger

Your fraud prevention program should stop fraud before it happens, not just react after the fact. Too many organizations take a passive approach, leaving them exposed.

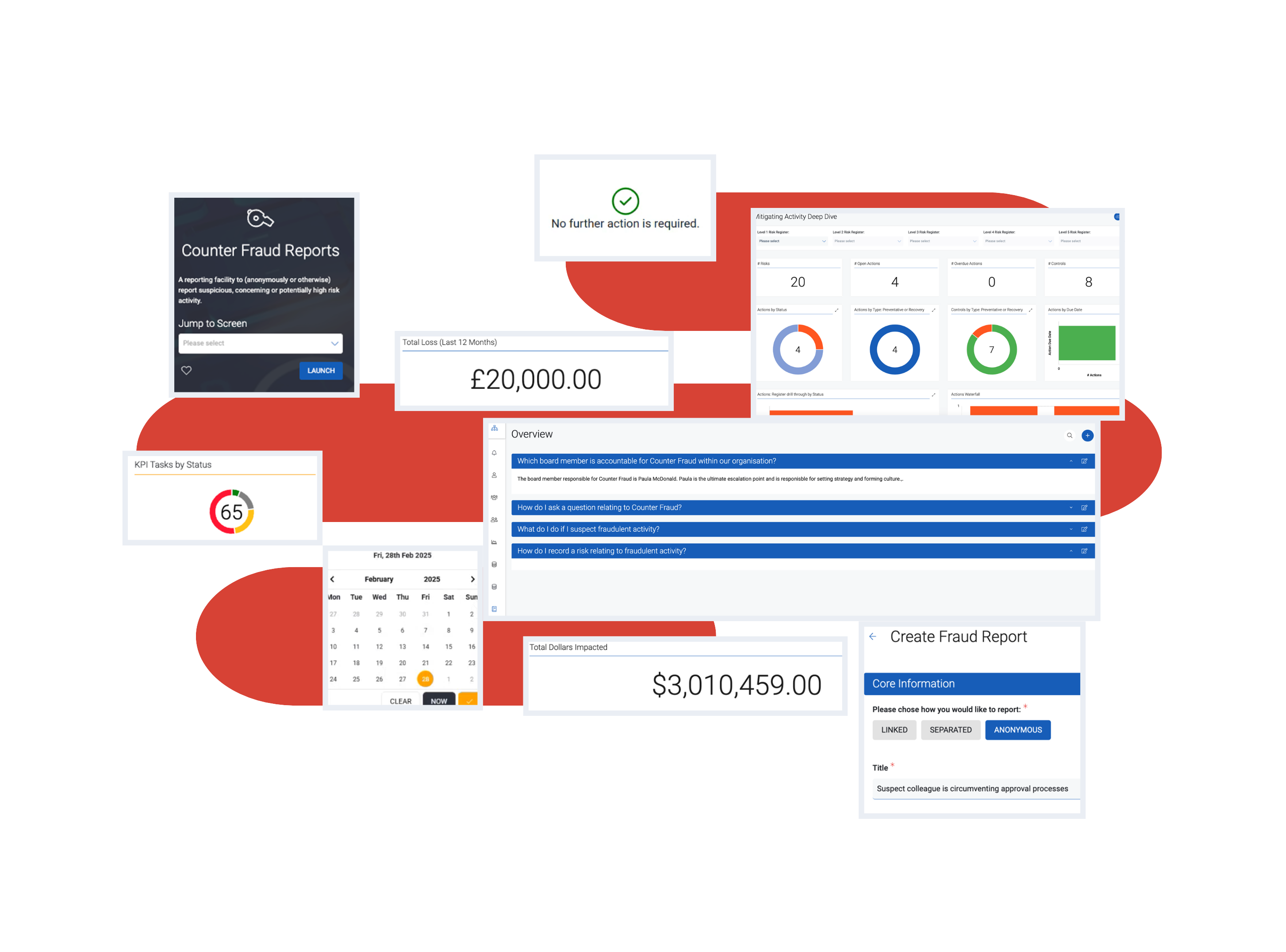

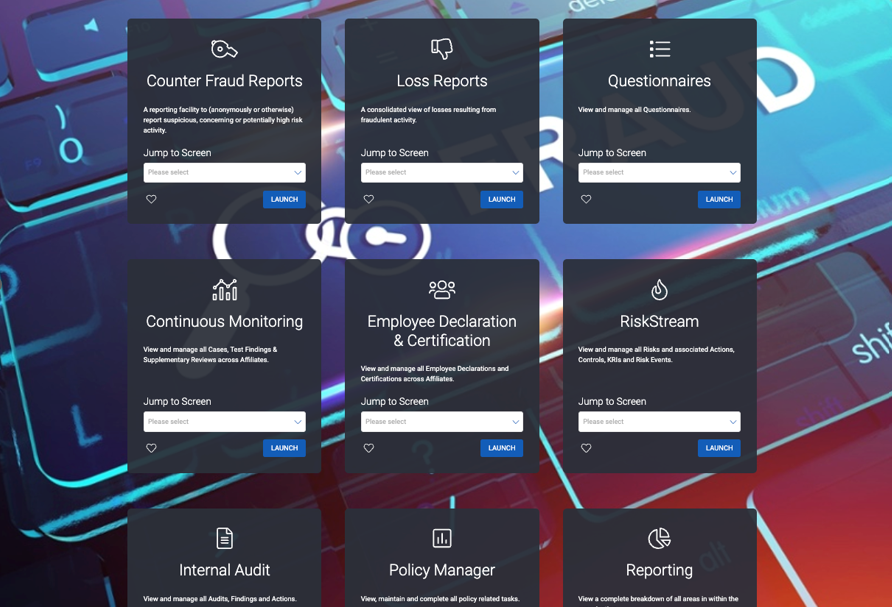

CoreStream GRC’s Counter Fraud software puts you in control with risk management surveys to assess fraud control maturity, action plans to drive continuous improvement, integrations to your LXP/LMS to strengthen awareness, and case management tools to ensure a swift, organized response. A secure whistleblowing feature empowers employees to flag concerns discreetly.

Trusted and preferred by global brands

Do these fraud prevention management challenges sound familiar?

“Tracking fraud-related action plans is a nightmare, we rely on spreadsheets, and things constantly fall through the cracks.”

“We struggle to keep fraud awareness training up to date, let alone ensure employees are actually completing it.”

“When fraud happens, our response is slow and disorganized because we lack a central case management system.”

“We rely on email for whistleblowing reports, which raises confidentiality concerns and makes it difficult to track cases properly.”

“We don’t have real-time visibility into our fraud risk landscape, making it difficult to report to senior management with confidence.”

Manage

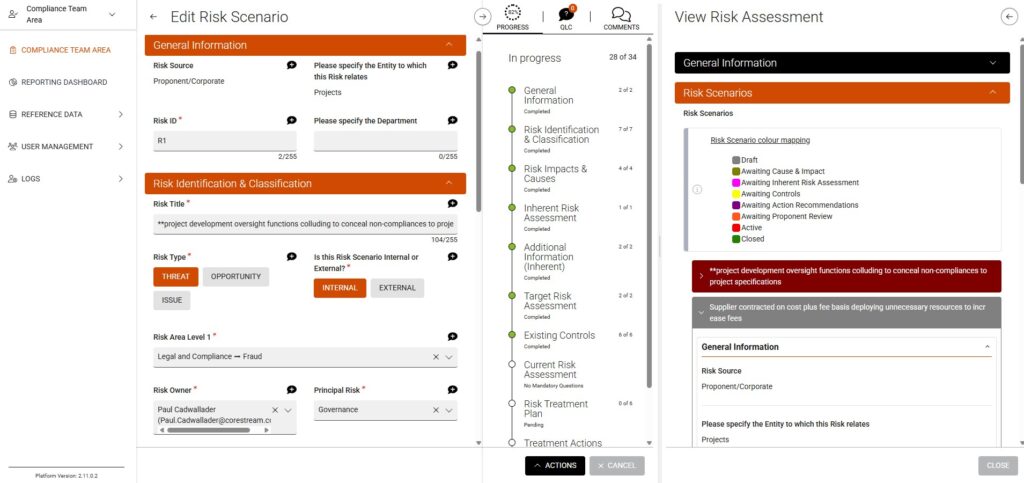

Fraud prevention is about staying ahead of evolving threats with a dynamic, end-to-end strategy. CoreStream GRC offers a bold, streamlined solution designed to proactively identify, manage, and mitigate fraud risks.

By integrating counter-fraud processes, compliance monitoring, and real-time reporting into a single platform, CoreStream GRC empowers organizations to take control of their risk landscape. No more scattered policies or disjointed action plans, just clear, consolidated oversight that drives smarter decisions and sharper outcomes.

Empower

At the heart of CoreStream GRC’s offering is its seamless information dissemination. With integrated guidance pages and eLearning modules, you can embed key policies, fraud prevention strategies, and best practices directly into your teams’ workflows. This ensures consistent knowledge transfer and reinforces vigilance across your organization.

Capture attestations, monitor compliance, and keep everyone aligned with the latest regulations, all through a user-friendly interface.

Predict

CoreStream GRC’s Fraud Prevention Management solution doesn’t just help you respond to fraud, it helps you anticipate and prevent it.

With robust process mapping capabilities, you can define and refine your fraud prevention workflows, ensuring they remain fit for purpose.

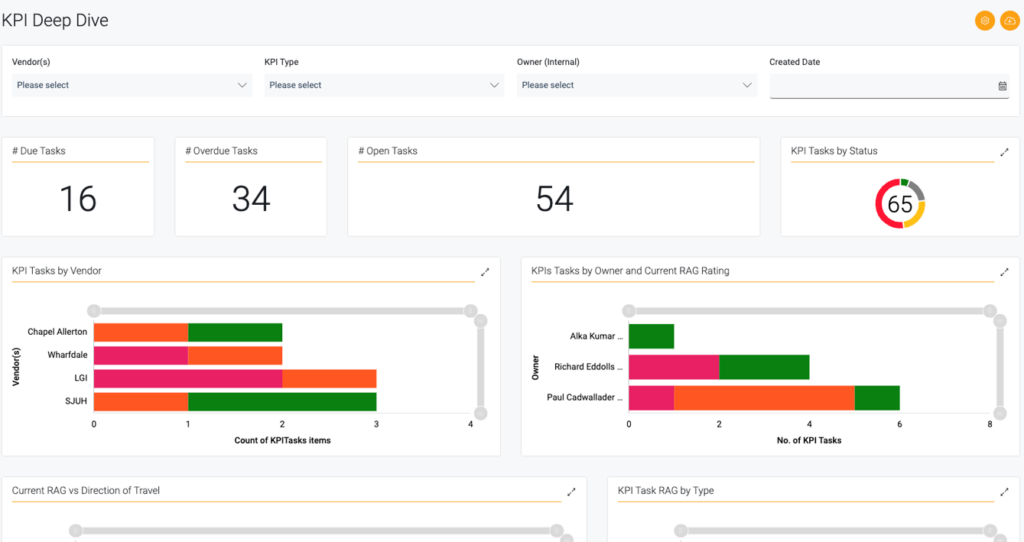

Track performance through a centralized KPI manager, link action plans to continuous improvement activities, and automatically trigger reminders for critical deadlines.

This ensures your fraud prevention efforts remain active, accountable, and constantly evolving.

Report

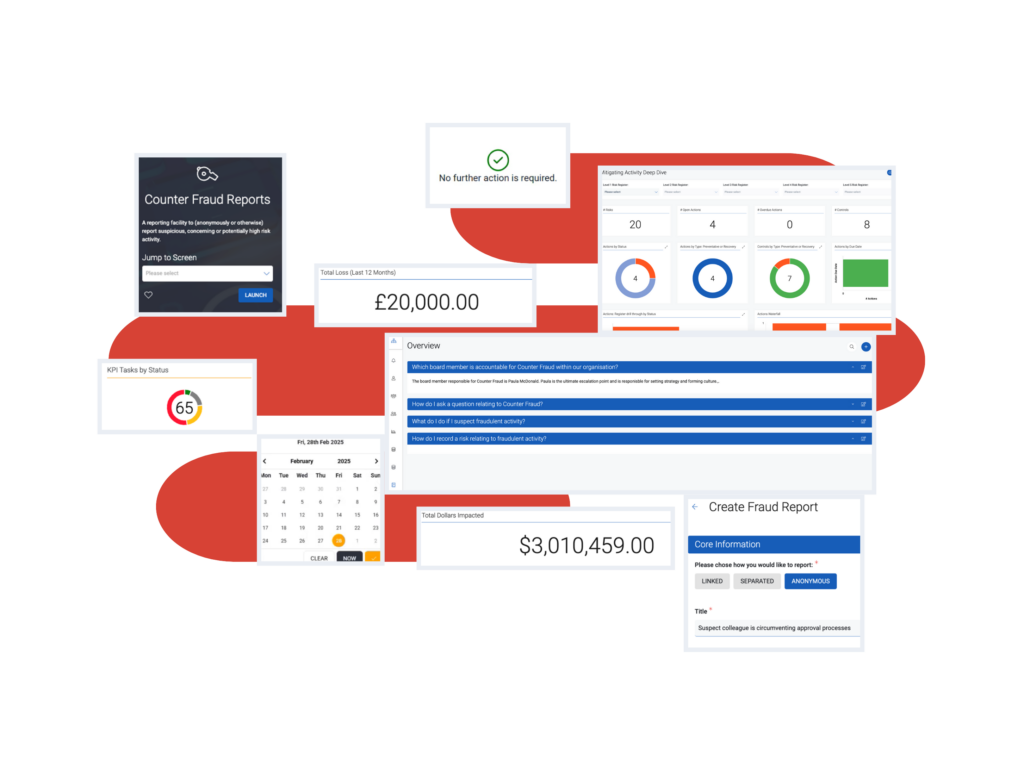

Detection and reporting are equally streamlined. CoreStream GRC’s Fraud Prevention Management solution provides clear, confidential reporting routes for staff, contractors, and the public to flag suspicions of fraud, bribery, or corruption.

With configurable workflows and case management capabilities, every referral is tracked, investigated, and resolved efficiently.

Losses are reported by type, department, or date range, with associated recovery actions captured for accountability.

Benefit from CoreStream GRC’s simple yet mighty Fraud Prevention Management solution

Your single source of truth via powerful integrations

Take control and prevent fraud effectively

Request a demo – contact us today!

This form may not be visible due to adblockers, or JavaScript not being enabled.

FAQs for fraud prevention management

The platform brings all fraud prevention activity into one central system, replacing scattered spreadsheets and disconnected workflows. You can assess fraud control maturity, run action plans, deliver training, and manage cases in a single environment. This gives you clearer oversight and a more proactive program that evolves as risks change. It also reduces administrative drag so your team can focus on real prevention.

Absolutely. The platform integrates seamlessly with your learning tools, making it easy to deliver training, push reminders, and confirm completion. You can track attestations, monitor compliance, and ensure your entire workforce stays aware of fraud risks. This helps build a culture where prevention becomes second nature, not a once-a-year exercise.

Yes. The whistleblowing feature gives employees, contractors, and the public a confidential route to raise concerns. Submissions are securely captured and routed to the correct team while preserving confidentiality and evidential integrity. This increases trust in the process and encourages people to speak up sooner.

You get dashboards and KPIs that show fraud risks, losses, investigations, and performance trends in real time. This gives senior leadership a clearer picture of emerging issues and control gaps. With this visibility, you can prioritize resources, refine controls, and make more confident decisions about your fraud prevention strategy.

Fraud threats evolve quickly, and regulators expect organisations to show that they actively monitor risks, not just react when issues surface. A proactive approach protects financial resources, strengthens internal controls, and safeguards reputation. It also builds a sense of vigilance across your teams, making it easier to detect and deter fraud early.

A strong fraud program includes risk assessments, awareness training, confidential reporting routes, structured investigations, continuous monitoring, and a clear action plan for improvement. When these elements work together in one system, you can move from firefighting to long term prevention and build a more resilient organization.